by Dr. Monroe Mann, PhD, Esq, MBA, LLM, ME, EMT

(Founder & Executive Director, Break Diving, Inc.)

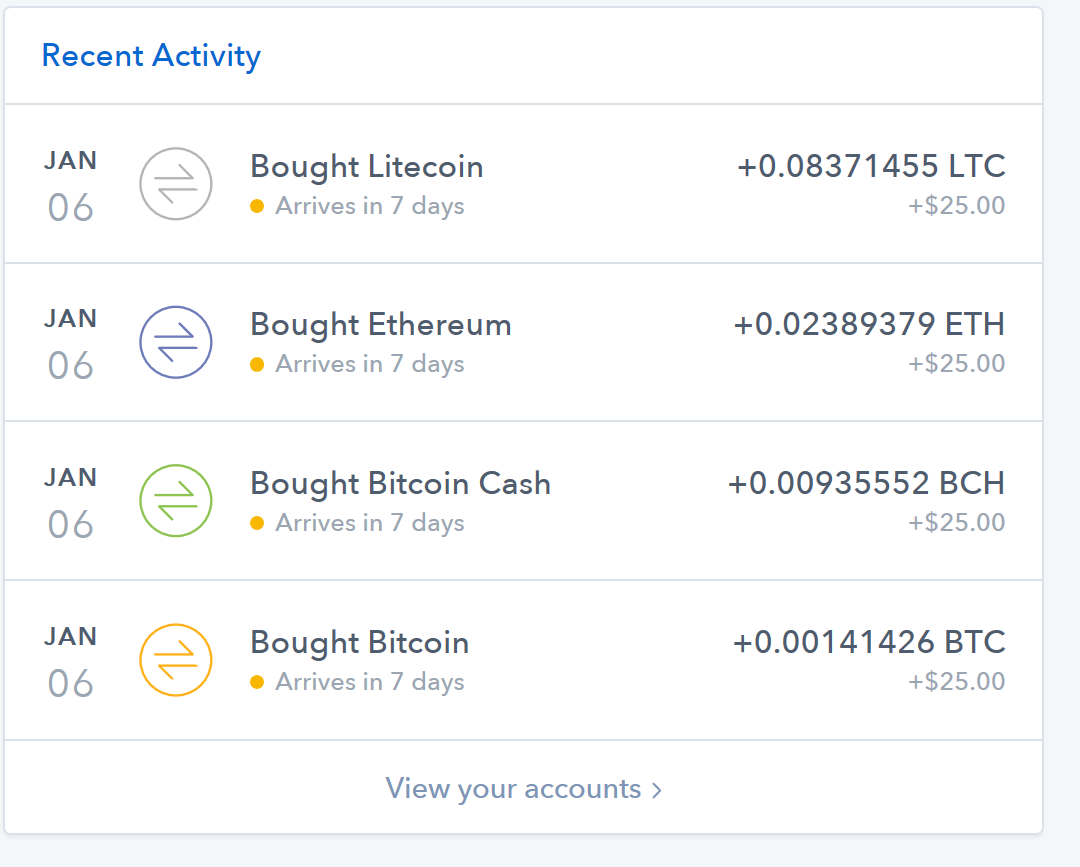

Last month, I made the following purchases:

In case you can’t decipher it, it simply states that I bought:

$25 in Bitcoin

$25 in Bitcoin cash

$25 in Ethereum

$25 in Lite Coin

I then bought another $50 of Ethereum based on a random tip from my doctor (more on that later). In other words, a total of $150 worth.

Fast forward to today, about 6 weeks later. The portfolio very briefly went above $150, and then quickly dropped to below $75. It has fluctuated from $75 to $120, and today is at $98.84. A few days ago it was at $112. Totally unpredictable except that I don’t think I’ll ever see it top $150… ever.

Here are all the lessons learned. Heed them well:

1. The Cryptocurrency ‘boom’ is probably over. I say probably because who really knows? Things happen. But all cryptocurrencies have dropped precipitously in the last 8 weeks. My point is: I don’t recommend you buy bitcoin or Ethereum as investments at this time.

2. Cryptocurrencies as a whole are probably here to stay. Many companies (like Expedia) are now allowing people to pay using Bitcoin. However, take a look at number (3) below, and that may change if things don’t stabilize soon.

3. You see, in order for cryptocurrencies to actually become a real ‘currency’, they need three qualities, and the most important being: it must be a dependable store of value. (You can research the other two!) In other words, imagine if a $100 American dollar bill were worth $250 today, and then $25 tomorrow. What a nightmare if you’re trying to shop; and if you’re a merchant, even worse, because each moment, you’ll never know how much your product and service sales will fetch on the market. It’s for this reason that many vendors are not actually pricing their items in bitcoin–they are only accepting bitcoin as a means of payment ,and pricing the items in dollars based on the current exchange rate. But even this is risky as a vendor: with the highly fluctuating value of cryptocurrencies, after you make a sale, if the price of that currency drops significantly, you just lost the value of your sale.

4. As Peter Lynch says in his book, “One Up on Wall Street”, a tip is NOT a ‘buy signal’–it’s a signal to do more research. I totally ignored his rule, and when my doctor mentioned Ethereum, I bought more, without doing any research. It didn’t matter that he thought Ethereum was going to go up in value. What mattered was whether I thought it would go up in value. And the truth is, I had no idea if it would. So why did I buy it? Pure speculation. That’s fine in some cases, but with $50 that was not part of my ‘speculation fund’? Mistake. And a mistake I will never make again.

So in sum:

1. Don’t buy cryptocurrencies now if your hope is make off like a bandit. It probably won’t happen.

2. Don’t be surprised if you start to see some companies accept payment via cryptocurrency and then a month later, they don’t.

3. If you are planning on using cryptocurrency to buy things, or accept payment via such cryptocurrencies, be careful: the price you pay or earn at 1pm may not be the price you pay or earn at 2pm for the exact same items.

4. Remember always: a tip is a research signal, and NOT a buy signal.

Now, go make your millions!

-Monroe

Take our free Break Diving 101 course at https://breakdiving.thinkific.com

Break Diving, Inc. is a tax-exempt 501(c)(3) charitable organization.

Read all about our amazing mission at www.BreakDiving.org

Join our free community at www.breakdiving.io

Like what we do? Please make a feel-good donation!

Remember to tell your friends about this www.BreakDiving.blog