by Dr. Monroe Mann, PhD, Esq, MBA, LLM, ME, EMT

Founder & Executive Director, Break Diving, Inc.

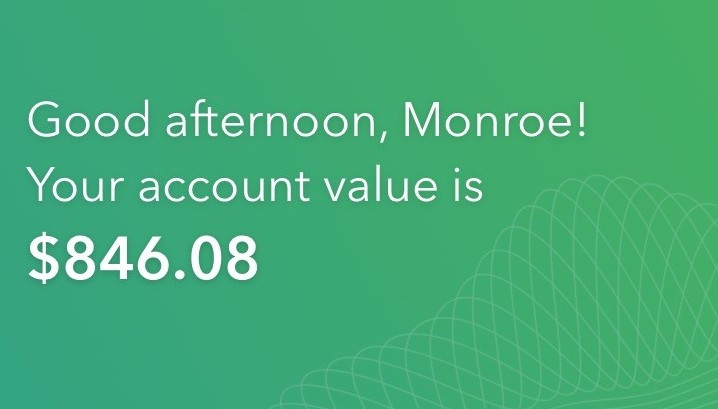

As promised, here is another of my Acorn Investment App updates. What started at $0 in August 2017, and then went to $75, and finally surpassed $500 is now at $846.08!

In fact, sometimes a picture is worth more than words. Here is a summary of all the screenshots I’ve taken since I started my Acorns account back in August of 2017:

That first one on the left was back in September or October of 2017. Just over 5 months ago. And look as the months go by: more, more, & more!

Last month, my strive was as follows: get to $1,000 before the end of March, and $1,500 by August (the 1-year mark). It’s February 26th now. I am on track. I may have to add an extra $50 beyond the roundups and recurring deposits, but that’s my mission: $1,000 before the end of March–and I’m gonna do my darndest to get there.

-Monroe

P.S. – I don’t only keep my money in Acorns. My entire ‘portfolio’ consists of: index funds (via Acorns), individual stocks (via RobinHood & Stockpile), treasury bonds, bills, notes, and savings bonds (via TreasuryDirect.gov), Whole & Term Life insurance (via NY Life), and regular cash savings accounts (CapitalOne360.com, formerly INGdirect). In order, from safest to more risky: Cash savings, NY Life accumulated cash value, US Treasury stuff, index funds, then individual stocks.

P.P.S. – You can read all of my Acorns posts from the beginning by starting here: The beginning of my Acorns journey.

Take our free Break Diving 101 course at https://breakdiving.thinkific.com

Break Diving, Inc. is a tax-exempt 501(c)(3) charitable organization.

Read all about our amazing mission at www.BreakDiving.org

Join our free community at www.breakdiving.io

Like what we do? Please make a feel-good donation!

Remember to tell your friends about this www.BreakDiving.blog