by Dr. Monroe Mann, PhD, Esq, MBA, LLM, ME, EMT

Founder & Executive Director, Break Diving, Inc.

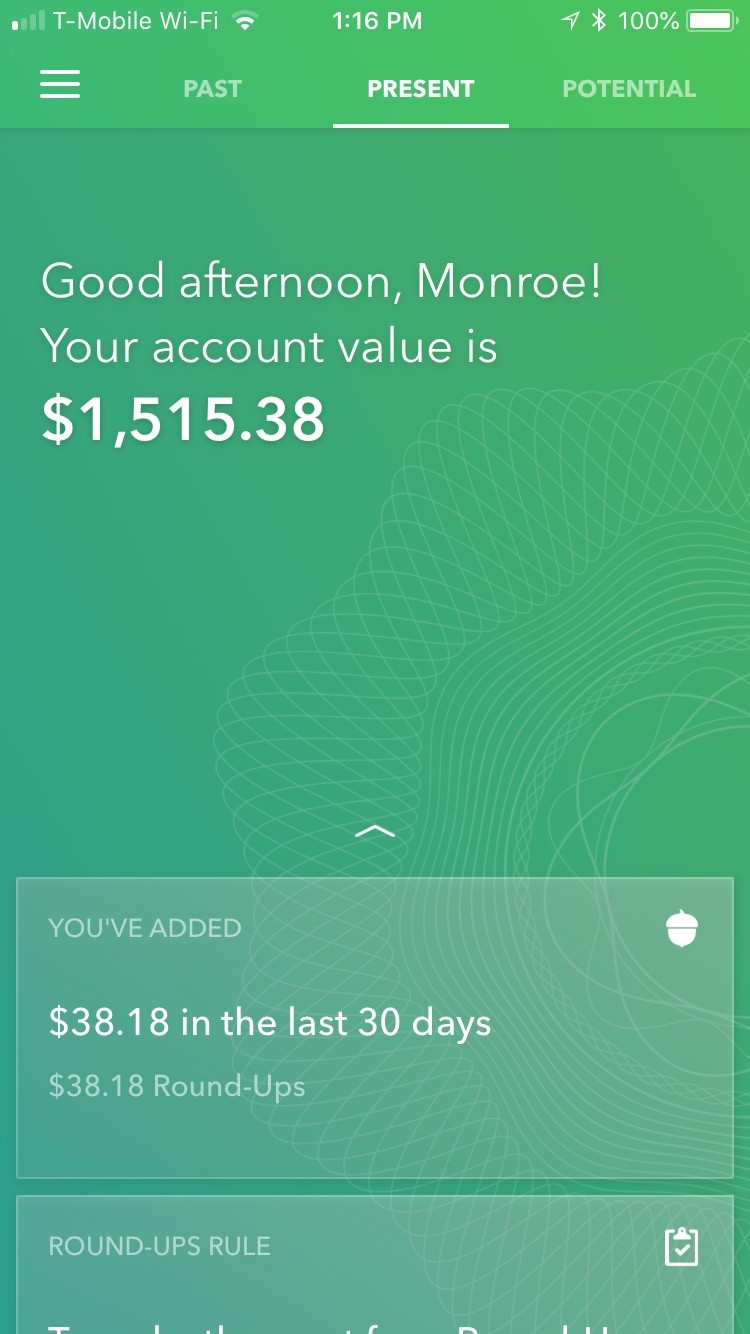

As promised, here is another of my Acorn Investment App updates. What started at $0 in August 2017, and then went to $75, then surpassed $500 in winter of 2017 is now at $1515.38 on September 2, 2018! We’re on the way to $2,000!

My hope in April was to get to $1,750 by August, but I haven’t been spending as much lately, so the amount of roundups inevitably dropped. I also reduced the weekly contribution to put more money into Stockpile and Robinhood, where I am slowly but surely becoming better at buying and selling at the right times.

So, my revised next target is $2,000 by Christmas.

I’ll keep my earlier target too of getting it to $10,000 by April 1, 2020. That’s two years from now. Bold, ambitious, and… I am going to work my butt off to make it happen. How about you?

Note: Acorns now offers IRAs. I have wanted to start one for years, and most IRAs require an initial investment of $1,000. In the last ten years, I never felt comfortable putting $1,000 into something I wouldn’t see for decades, but now, I see things differently (perhaps because I am getting older). Further, with the Acorns IRA, you can start with as little as you want. Even $25. I’ve started small, and am adding $30/month. I’m up to about $130 now. A modest beginning, but, a beginning, and I am excited to increase that monthly amount in the years to come. By law, I can put in a max of about $5,500 per year, so my target is to eventually raise the monthly contribution to $500/month, which would max it out.

In other investment news, the Break Diving endowment fund now has over $500 in it! It’s really coming along! Do you want to help us reach $1,000? Please make a contribution!

-Monroe

P.S. – As I mention in each of these posts, it’s important to know that I don’t only keep my money in Acorns. My entire ‘portfolio’ consists of: index funds (via Acorns), individual stocks (via RobinHood & Stockpile), treasury bonds, bills, notes, and savings bonds (via TreasuryDirect.gov), Whole & Term Life insurance (via NY Life), and regular cash savings accounts (CapitalOne360.com, formerly INGdirect, and Chase). In order, from safest to more risky: Cash savings, NY Life accumulated cash value, US Treasury bonds, index funds, then individual stocks. I also now regularly use the amazing budgeting app called You Need a Budget, which makes a lot of sense and has already resulted in me using my money more wisely. I intend to write a full article on this soon!

P.P.S. – You can read all of my Acorns posts from the beginning by starting here: The beginning of my Acorns journey.

Break Diving, Inc. is a tax-exempt 501(c)(3) charitable organization.

Read all about our amazing mission at www.BreakDiving.org

Join our free community at www.breakdiving.io

Like what we do? Please make a feel-good donation!

Remember to tell your friends about this www.BreakDiving.blog